The price of Bitcoin has been locked in a corrective wave since the middle of March, after reaching its all-time high vertically in the wake of the validation of spot Bitcoin ETFs by the Securities and Exchange Commission (SEC). While the halving is imminent, Bitcoin is still looking for its low point.

The FED’s pivot postponed to 2025?

Since October 2023, the major stock market trends have been shaped by a single theme: the highly anticipated and thunderous pivot of the Central Banks, especially that of the Federal Reserve (FED) and the European Central Bank (ECB).

While the ECB's pivot seems certain for this year with 4 rate cuts by the end of the year, that of the FED could not take place in 2024, enough to pose a risk of crash at the same time on the United States stock market and on the bond market (which has already experienced a major crash in 2022 and 2023).

So what's going on?

Let's take things in a logical order: what are the reasons that could lead the FED to initiate a downward trend in the federal funds rate from the 2023 peak at 5.5%?

The first reason is the defeat of inflation, that is, a belief that underlying inflation will continue to fall towards 2% even if the pivot takes place. Powell's FED does not have this conviction at the current stage, with an unexpected update of disinflation over the months of February and March for the PPI, the CPI and the PCE.

👉 How to buy Bitcoin easily? follow the leader

The second reason could be an increase in the risk of recession in the United States economy, but the recent update of hard data and soft data seems to rule out this hypothesis, it is still the soft landing which is the main scenario on the table. The US services PMI is still expanding and the IMF has revised upwards its growth forecast for 2024.

The third reason could be an increase in the US unemployment rate above the threshold of 4.1% of the active population. For the moment, it is stable at 3.8%.

The FED will pivot when inflation starts to avoid disrupting US economic growth which ensures profit growth. Next up, the PCE inflation update on Friday, April 26.

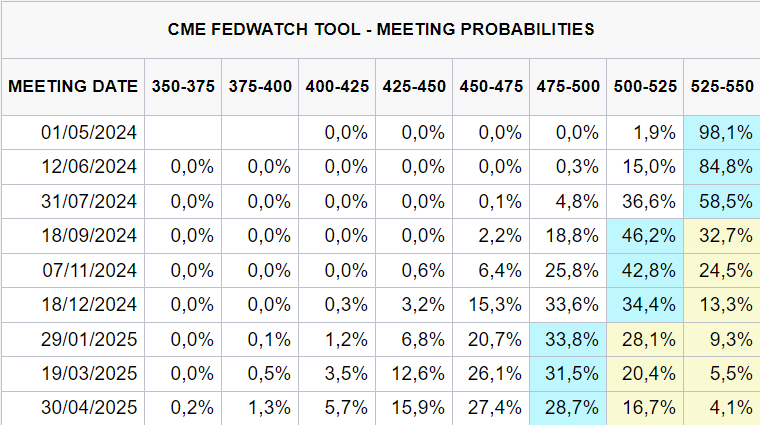

CME FED Watch tool which describes expectations of changes in the federal funds rate in the United States

Cryptoast Research: Take advantage of 50% off to celebrate the halving!🎁 As the halving approaches, Bitcoin is becoming rarer, but not our analyses! Enjoy 50% Off Your Cryptoast Research Subscription to benefit from in-depth market analyzes (limited time offer).

👉 Also find Vincent Ganne in video on the Cryptoast Research YouTube channel:

Bitcoin looking for the bottom of its correction wave

In terms of technical analysis, the price of Bitcoin could be close to having completed its correction wave which was initiated in the middle of last March. The market currently offers a regular flat structure using the terminology of Elliott waves.

The bottom of BTC could be in the area of 57,000/60,000 dollars, but only the overcoming of a resistance will validate the low point of BTC, and it is every morning and on video that I give you my opinion trading on BTC and altcoins.

You want to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins, then join the professional Cryptoast Research service! Satisfied or refunded for 15 days so don't hesitate any longer! 50% off all our packages until April 23 at midnight

Chart which reveals the Japanese intraday candles (H4) of the BTC/USD price

Chart which reveals the Japanese intraday candles (H4) of the BTC/USD price

To deepen my technical analyses, find me on the Cryptoast Research YouTube channel!

Find technical analyzes from Vincent Ganne on Cryptoast Research, the ideal place to make your investments in cryptocurrencies successful. You will learn how to position yourself on strategic price levels, spot investment opportunities and anticipate price movements. Join us now and take charge of your crypto investments with 50% off for a limited time 🎁

Cryptoast Research: Take advantage of 50% off to celebrate the halving!Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.